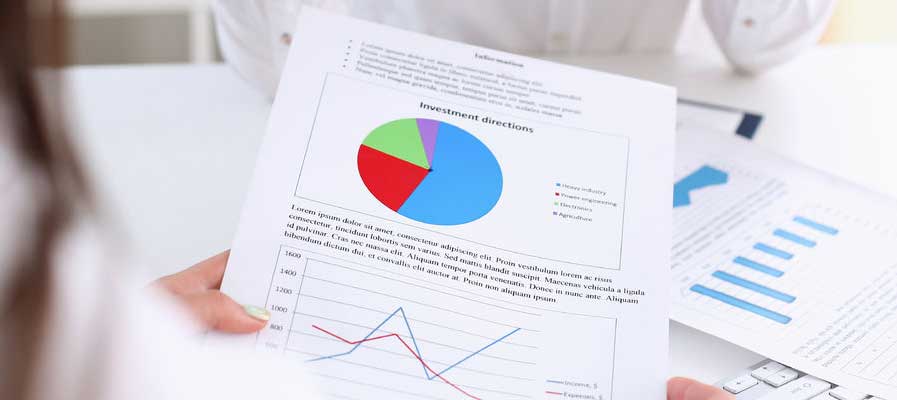

In this section, we’ll guide you through the intricacies of business taxes, offering insights, strategies, and expert advice to ensure your company remains tax-efficient and compliant. Whether you’re a seasoned entrepreneur, a small business owner, or just embarking on your entrepreneurial journey, understanding the nuances of business taxation is crucial. Join us as we demystify the world of corporate taxes and empower you to make informed financial decisions for the success of your business.

The 2025 Trump Tax Bill: What It Means for Families and Small Businesses

2025-05-22T20:57:05+00:00The new 2025 tax bill, an update and extension of the 2017 Trump-era tax cuts, brings a mix of tax breaks and hidden trade-offs. If you’re a family trying to budget or a small business trying to grow, it’s important to understand how this bill might affect your wallet—not just today, but in the years ahead. Let’s break it down in plain English. What’s Changing for Everyday Americans? Lower Tax Rates Continue Your federal income tax rates stay lower than they were before 2017. The top rate stays at 37%, not 39.6%. That means many families and business owners will still pay less in taxes [...]